I love Woody Allen and this movie is one of his best. The actors are superb and the story is a mixture of funny and dramatic situations. It's a must for Woody Allen's fans.

I. Discuss the questions below with a partner.

1. What is financial literacy, in your opinion.

2. How can financial literacy benefit consumers of all ages?

3. How informed are people about financial literacy?

4. How does your level of financial literacy affect your quality of life?

II. Now read the text below and check your answers:

Taken from the informative site:

Financial literacy is the ability to understand how money works: how

someone makes, manages and invests it, and also expends it (especially when one

donates to charity) to help others.

In-depth knowledge of financial literacy is required to understand how

money works and how it can work for you – even when you’re sleeping – by

investing in profitable areas like the stock or money market. To understand

money and how it works, it’s important to understand common financial literacy

principles such as; financial goals, budgeting, investments, superannuation,

contracts and employment models.

Research studies across countries on financial literacy have shown that

most individuals (including entrepreneurs) don’t understand the concept of

compound interest and some consumers don’t actively seek out financial

information before making financial decisions. Most financial consumers lack

the ability to choose and manage a credit card efficiently, and lack of

financial literacy education is responsible for lack of money management skills

and financial planning for business and retirement.

Most potential retirees lack information about saving and investing for

retirement. Many people fail to plan ahead and they take on financial risks

without realizing it. Problems of debt are severe for a large proportion of the

population because of financial illiteracy. Youth on average are less

financially capable than their elders.

Financial education can benefit consumers of all ages and income levels.

For young adults just beginning their working lives, it can provide basic tools

for budgeting and saving so that expenses and debt can be kept controlled.

Financial education can help families acquire the discipline to save for their

own home and/or for their children’s education. It can help older workers

ensure that they have enough savings for a comfortable retirement by providing

them with the information and skills to make wise investment choices with their

individual pension and savings plans. Financial education can help low-income

people make the most of what they are able to save and help them avoid the high

cost charged for financial transactions by non-financial institutions.

Your level of financial literacy affects your quality of life

significantly. It affects your ability to provide for yourself and family, your

attitude to money and investment, as well as your contribution to your

community. Financial literacy enables people to understand what is needed to

achieve a lifestyle that is financially balanced, sustainable, ethical and

responsible. It also helps entrepreneurs leverage other people’s money for

business to generate sales and profits.

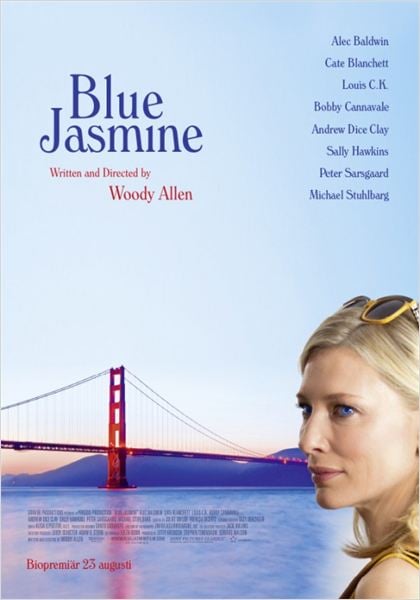

III. Watch the segment from the movie Blue Jasmine and discuss the questions in small groups.

1. How financially literate is Jasmine? Explain it.

2. What about her ex-husband?

3. How did the way they dealt with their finances affect their lives? What advice would you give them both?

4. How does Jasmine manage her finances now? Is she financially literate now? Justify it.

5. How do you see yourself? Are you financially literate? Why (not)?

6. How can you you improve your finances now?

7. Do you take care of your future? Do you have retirement plans? Investments? Debts? Explain how you manage your financial life?

MOVIE SEGMENT DOWNLOAD - BLUE JASMINE

Financial

literacy is the ability to understand how money works: how someone

makes, manages and invests it, and also expends it (especially when one

donates to charity) to help others.

In-depth knowledge of financial literacy is required to understand

how money works and how it can work for you – even when you’re sleeping –

by investing in profitable areas like the stock or money market. To

understand money and how it works, it’s important to understand common

financial literacy principles such as; financial goals, budgeting,

investments, superannuation, contracts and employment models.

Research studies across countries on financial literacy have shown

that most individuals (including entrepreneurs) don’t understand the

concept of compound interest and some consumers don’t actively seek out

financial information before making financial decisions. Most financial

consumers lack the ability to choose and manage a credit card

efficiently, and lack of financial literacy education is responsible for

lack of money management skills and financial planning for business and

retirement.

Most potential retirees lack information about saving and investing

for retirement. Many people fail to plan ahead and they take on

financial risks without realizing it. Problems of debt are severe for a

large proportion of the population because of financial illiteracy.

Youth on average are less financially capable than their elders.

Financial education can benefit consumers of all ages and income

levels. For young adults just beginning their working lives, it can

provide basic tools for budgeting and saving so that expenses and debt

can be kept controlled. Financial education can help families acquire

the discipline to save for their own home and/or for their children’s

education. It can help older workers ensure that they have enough

savings for a comfortable retirement by providing them with the

information and skills to make wise investment choices with their

individual pension and savings plans. Financial education can help

low-income people make the most of what they are able to save and help

them avoid the high cost charged for financial transactions by

non-financial institutions.

Your level of financial literacy affects your quality of life

significantly. It affects your ability to provide for yourself and

family, your attitude to money and investment, as well as your

contribution to your community. Financial literacy enables people to

understand what is needed to achieve a lifestyle that is financially

balanced, sustainable, ethical and responsible. It also helps

entrepreneurs leverage other people’s money for business to generate

sales and profits.

- See more at: http://www.cybf.ca/2013/meaning-financial-literacy/#sthash.InvtV2DI.dpuf

Financial

literacy is the ability to understand how money works: how someone

makes, manages and invests it, and also expends it (especially when one

donates to charity) to help others.

In-depth knowledge of financial literacy is required to understand

how money works and how it can work for you – even when you’re sleeping –

by investing in profitable areas like the stock or money market. To

understand money and how it works, it’s important to understand common

financial literacy principles such as; financial goals, budgeting,

investments, superannuation, contracts and employment models.

Research studies across countries on financial literacy have shown

that most individuals (including entrepreneurs) don’t understand the

concept of compound interest and some consumers don’t actively seek out

financial information before making financial decisions. Most financial

consumers lack the ability to choose and manage a credit card

efficiently, and lack of financial literacy education is responsible for

lack of money management skills and financial planning for business and

retirement.

Most potential retirees lack information about saving and investing

for retirement. Many people fail to plan ahead and they take on

financial risks without realizing it. Problems of debt are severe for a

large proportion of the population because of financial illiteracy.

Youth on average are less financially capable than their elders.

Financial education can benefit consumers of all ages and income

levels. For young adults just beginning their working lives, it can

provide basic tools for budgeting and saving so that expenses and debt

can be kept controlled. Financial education can help families acquire

the discipline to save for their own home and/or for their children’s

education. It can help older workers ensure that they have enough

savings for a comfortable retirement by providing them with the

information and skills to make wise investment choices with their

individual pension and savings plans. Financial education can help

low-income people make the most of what they are able to save and help

them avoid the high cost charged for financial transactions by

non-financial institutions.

Your level of financial literacy affects your quality of life

significantly. It affects your ability to provide for yourself and

family, your attitude to money and investment, as well as your

contribution to your community. Financial literacy enables people to

understand what is needed to achieve a lifestyle that is financially

balanced, sustainable, ethical and responsible. It also helps

entrepreneurs leverage other people’s money for business to generate

sales and profits.

- See more at: http://www.cybf.ca/2013/meaning-financial-literacy/#sthash.InvtV2DI.dpuf

Financial

literacy is the ability to understand how money works: how someone

makes, manages and invests it, and also expends it (especially when one

donates to charity) to help others.

In-depth knowledge of financial literacy is required to understand

how money works and how it can work for you – even when you’re sleeping –

by investing in profitable areas like the stock or money market. To

understand money and how it works, it’s important to understand common

financial literacy principles such as; financial goals, budgeting,

investments, superannuation, contracts and employment models.

Research studies across countries on financial literacy have shown

that most individuals (including entrepreneurs) don’t understand the

concept of compound interest and some consumers don’t actively seek out

financial information before making financial decisions. Most financial

consumers lack the ability to choose and manage a credit card

efficiently, and lack of financial literacy education is responsible for

lack of money management skills and financial planning for business and

retirement.

Most potential retirees lack information about saving and investing

for retirement. Many people fail to plan ahead and they take on

financial risks without realizing it. Problems of debt are severe for a

large proportion of the population because of financial illiteracy.

Youth on average are less financially capable than their elders.

Financial education can benefit consumers of all ages and income

levels. For young adults just beginning their working lives, it can

provide basic tools for budgeting and saving so that expenses and debt

can be kept controlled. Financial education can help families acquire

the discipline to save for their own home and/or for their children’s

education. It can help older workers ensure that they have enough

savings for a comfortable retirement by providing them with the

information and skills to make wise investment choices with their

individual pension and savings plans. Financial education can help

low-income people make the most of what they are able to save and help

them avoid the high cost charged for financial transactions by

non-financial institutions.

Your level of financial literacy affects your quality of life

significantly. It affects your ability to provide for yourself and

family, your attitude to money and investment, as well as your

contribution to your community. Financial literacy enables people to

understand what is needed to achieve a lifestyle that is financially

balanced, sustainable, ethical and responsible. It also helps

entrepreneurs leverage other people’s money for business to generate

sales and profits.

- See more at: http://www.cybf.ca/2013/meaning-financial-literacy/#sthash.InvtV2DI.dpuf